每周全球金融观察 | 第 155 篇:精彩纷呈的 2023 年

来源:岭南论坛 时间:2023-12-31

今天是 2023 年 12 月 31 日。事后看来,我为 2023 年的最后一篇文章选择了 "精彩纷呈的2023 年"作为标题。

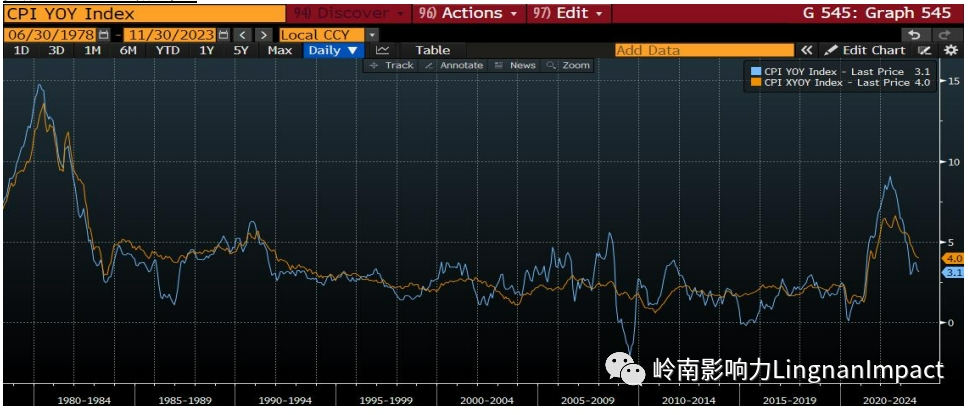

2022 年是灾难性的一年,投资者在股票和债券的双重屠杀中舔舐伤口,在此之后,几乎没有人敢奢望 2023 年会是全球金融市场的丰收年。在华尔街,著名的经济学家和策略师在进入 2023 年时一边倒地持负面看法,认为通胀失控、无情加息和经济衰退迫在眉睫。大多数人以蔑视熊市的呼声对抗市场复苏,直到他们被雷霆万钧的牛市击倒。历史上最被广泛预期的经济衰退和随之而来的股市崩溃从未到来。一位著名的首席投资官引用道:"我从未见过卖方的共识像 2023 年那样错误"。

2023 年是一个痛苦的提醒: 仅靠模型并不能真正预测经济。市场 (股市、固定收益、货币)的可预测性不能单纯依靠模型和经济数据。

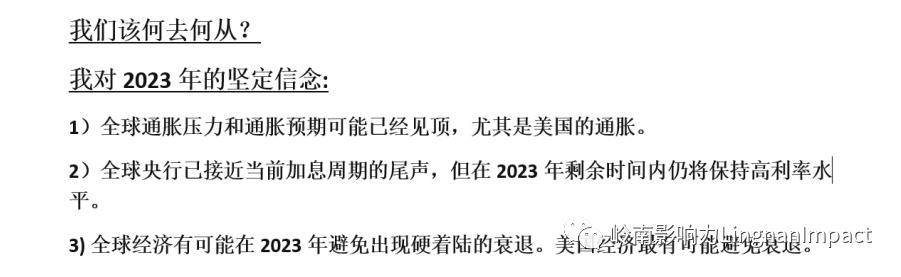

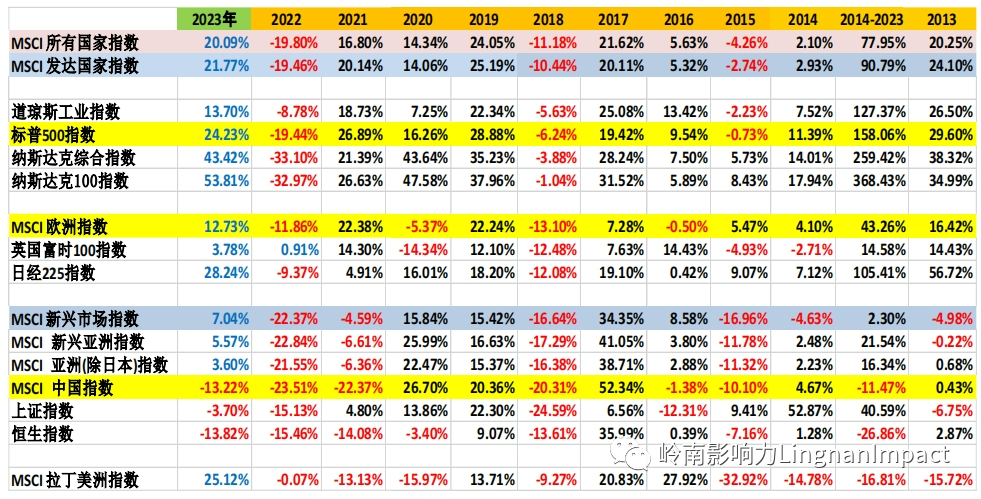

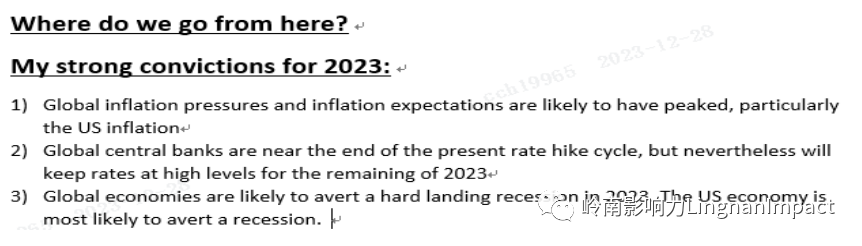

11 月和 12 月的表现令人震惊。道指和纳斯达克 100 指数分别在 12 月 13 日和 15 日创下历史收盘新高,并在 12 月底屡次创下新高。纳斯达克 100 指数在 2023 年上涨了 53.81%,是自1993 年以来涨幅最好的一年。虽然纳斯达克综合指数尚未创下历史新高(自 2021 年 11 月19 日以来),但 2023 年的涨幅达到 43.42%,是自 2003 年以来涨幅最好的一年。标准普尔500 指数全年上涨 24.23%,距离 2022 年 1 月 3 日创下的历史新高仅差 0.55%。

对于大多数市场(和长期投资者)来说,2023 年是美妙的一年。这一年(事后看来)赚钱并不难。只要躺平就能赚取超额回报。

首先,3 个月、6 个月和 1 年期美元存款年初分别为 4.77%、5.11% 和 5.44%,最高分别为5.82%、5.95% 和 6.00%,年末分别为 5.43%、5.37% 和 5.26%。

3 个月、6 个月和 1 年期美元存款利率:

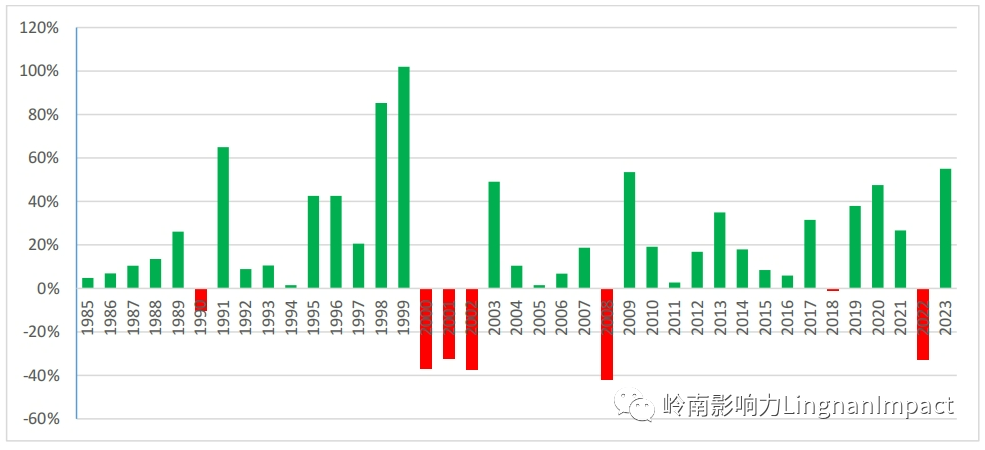

今年年初,全球固定收益市场走势坚挺,进入 7 月份后回报可观,但在 8 月,9 月和 10 月出现大幅回调。然而,随着加息周期的结束和 2024 年降息预期的形成,全球固定收益市场在11 月和 12 月开始起飞。

事实上,65 万亿美元(等值)的彭博全球综合指数创下了自 1990 年以来最好的两个月表现,11 月和 12 月涨幅达 9.41% (2023 年全年为 5.72%)。

彭博全球综合指数: 1990-2023 年价格图:

作为全球最受关注的基准利率,10 年期美国国债收益率年初为 3.88%。四月初,由于对硅谷银行崩溃的经济衰退的担忧 (并没有发生) 跌至 3.30%,10 月中旬短暂达到 4.99% 的里程碑,年末为 3.88%。在整个 2023 年,美国收益率曲线一直保持倒挂。年底, 10 年期和 2年期息差为 -37 个基点。自 2022 年 7 月以来,收益率曲线一直出现倒挂。所有基于美国国债收益率曲线倒挂而断言 2023 年美国将陷入衰退的人都错得离谱。美国经济的韧性出乎所有人的意料。

10 年期美国国债收益率:2023 年年初为 3.88%,年底为 3.88%;

全球股市在今年取得了令人难以置信的成绩(MSCI 中国指数和恒生指数除外)。最引人注目的是半导体(SOX 指数)上涨了 64.90%,纳斯达克 100 指数(NDX 指数上涨了 53.81%,纳斯达克综合指数上涨了 43.42%。

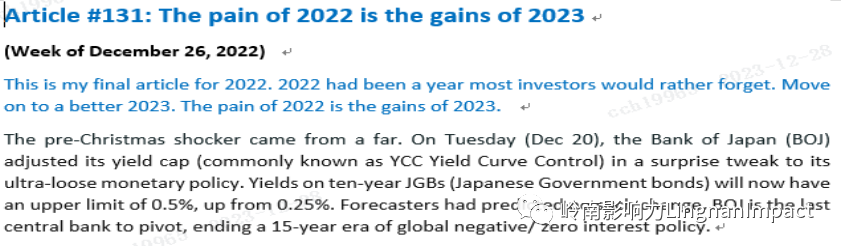

顺便提一句,我在 2022 年的最后一篇文章的标题是 "2022 年的痛苦将是 2023 年的收获",现在看来有先见之明。

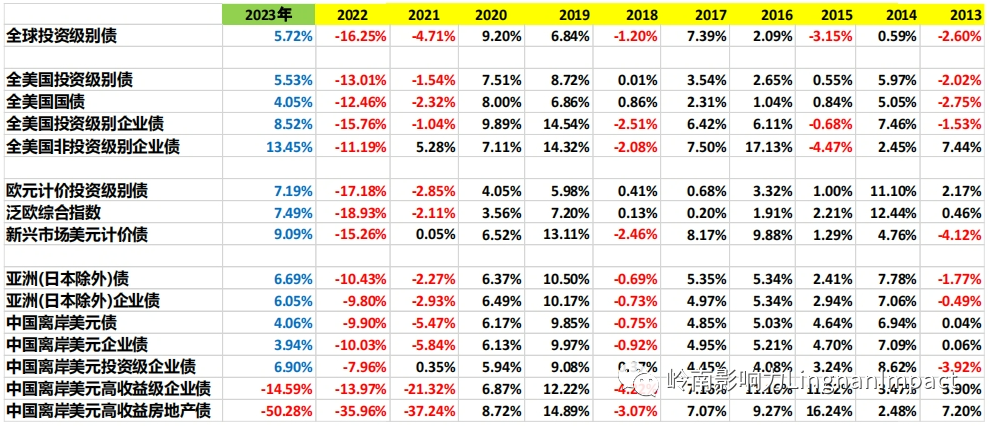

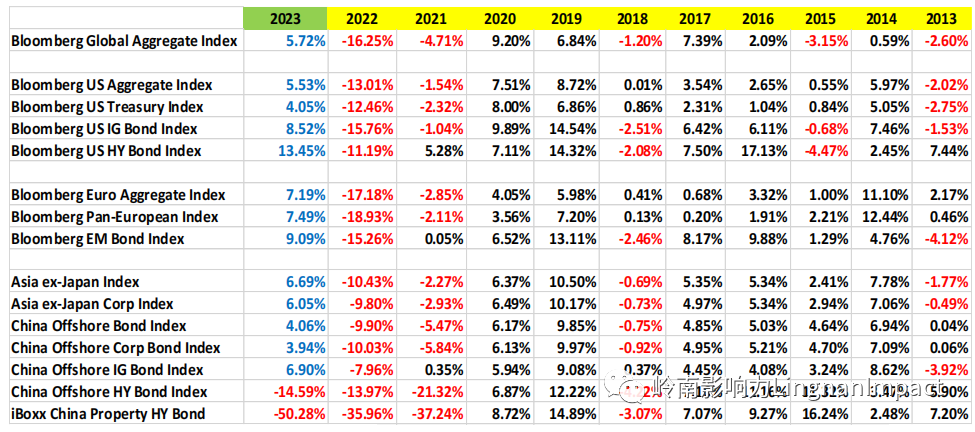

有关 2023 年与往年对比,请参见下表:

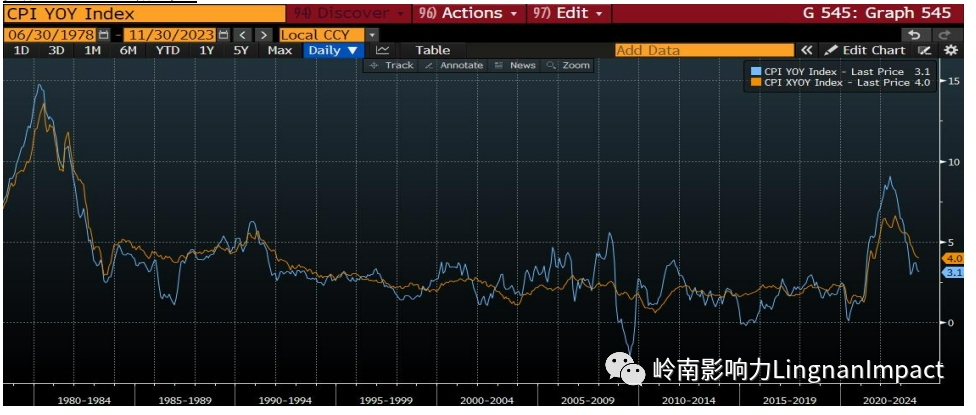

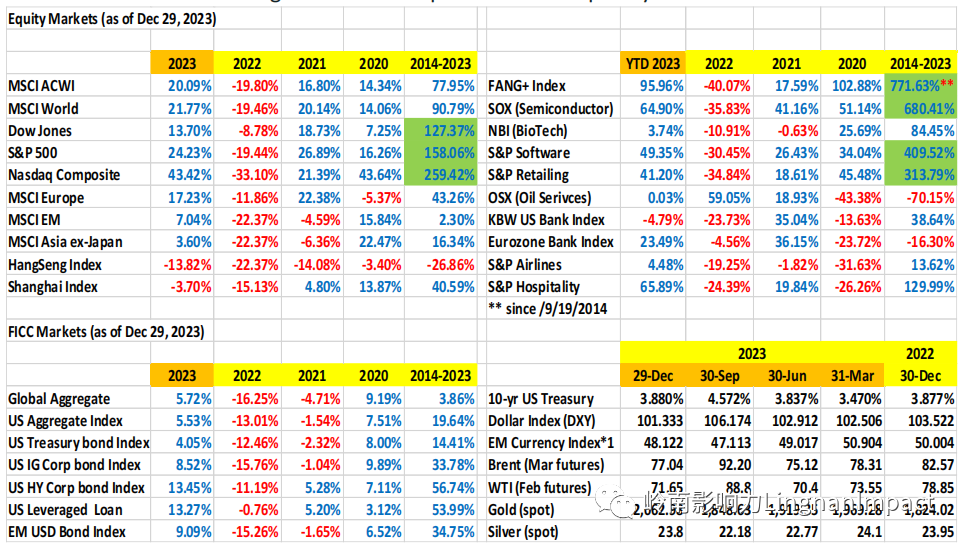

全球通胀已经消退。各国央行已经准备好庆祝他们在遏制通胀方面取得的成功。然而,市场的欢呼声需要缓和。预计 2022/2023 年加息周期已经结束是现实的,但大规模降息的预期是非理性的。降息的速度和幅度将比 2022/2023 年的加息速度和幅度要慢得多,也小得多。

美国 CPI 通胀率:

欧元区通胀率:

全球固定收益市场:

固定收益市场已经跑在了美联储和圣诞老人的前面,并在11月和12月将2024年预期收益的很大一部分预先提取。10年期美国国债收益率为3.88%,2年期美国国债收益率为4.25%,我们需要保持现实的乐观。

此外,信贷息差(尤其是投资级信贷)的压缩空间有限。

美国高收益债券和美国投资级债券:信用利差:

我认为,G-7无风险政府债券目前的上涨空间有限。投资级债信贷息差几乎没有太多压缩的空间。

我预计2024年全球股市将出人意料地好,美国市场将继续领跑,科技板块将继续跑赢大盘(很可能没有2023年那么多)。

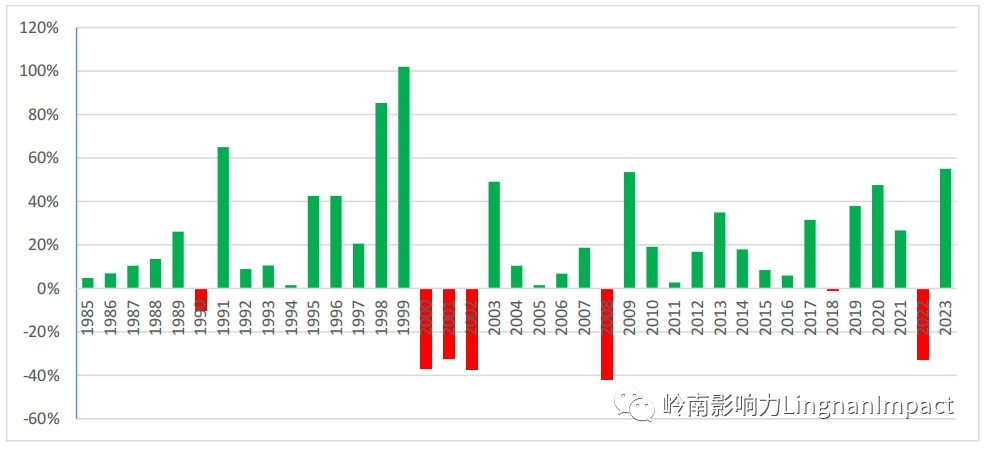

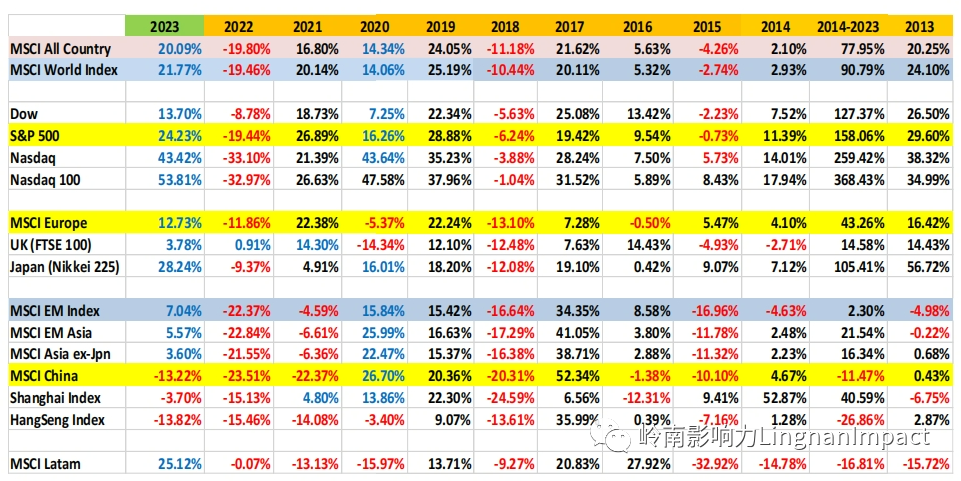

纳斯达克100指数在2023年创造了奇迹,上涨了53.81%,是自1991年以来涨幅最好的一年(超过了2020年47.58% 的涨幅)。赞成均值回归论的人请记住,纳斯达克100指数在20世纪90年代后期曾连续5年实现两位数的涨幅(1995年54%,1996年42.54%,1997年20.63%,1998年85.31%,2000年101.95%)。当然,2000年互联网泡沫破灭后,出现了三个负收益年(2000年-36.84%,2001年-32.65%,2002年-37.58%)。2023年的超额收益是由人工智能的蓬勃发展推动的(就像20世纪90年代的互联网时代)。我不认为人工智能时代在短短一年内就结束了,也不认为这种繁荣已经达到了泡沫的地步。

纳斯达克100 指数自1985 年创立以来的年度回报率:

我预计,牛市将2024年蔓延到许多非科技行业(金融和工业)以及小型股。事实上,在11月和12月,道琼斯指数上涨了15.14%,小盘股罗2000指数在这两个月里上涨了21.95%。2024年,小盘股(罗素2000 指数)的表现很有可能超过纳斯达克100指数(相对百分比和数学)。

我预计当2024年的降息预期开始被计入,新兴市场股票将在2024年复苏。MSCI新兴市场指数在11月和12月的涨幅为+11.86%。

更重要的是,资金雪崩即将来临。货币市场基金资产从疫情前的3.6万亿美元增加到最近的5.88万亿美元,银行存款从不到14万亿美元增加到最近的17.59万亿美元。当降息被定价时,我们将看到资金从“躺平”资产(货币市场基金和银行存款)流出,转而投向风险资产。由于固定收益的定价已臻完美,美国股票和新兴市场股票将成为首选受益者。

也许现在加入牛市还为时不晚?

作者:蔡清福

Alvin C. Chua

2023 年12月31 日星期日

我对2024年的五大预测:

Today is December 31, 2023. With perfect hindsight, I picked the heading “What a fabulous year2023 has been” for my final article of 2023.

After a disastrous 2022 with investors licking their wounds from a double whammy of stock andbond massacre, few of us would dare to expect 2023 to be a good year for the global financialmarkets. On Wall Street, prominent economists and strategists were overwhelmingly negativecoming into 2023, calling for run-away inflation, relentless interest rate hikes, and an impendingrecession. Most fought the market recovery with defiant bearish calls, until they were humbledby the thundering bulls. The most widely anticipated recession in history and the ensuing stockmarket debacle never came. One prominent CIO quoted “I have never seen the sell-sideconsensus as wrong as it was in 2023.”

2023 is a painful reminder that models alone do not really work to predict the economy. Markets(equities, fixed income, currencies) are far less predictable simply by models and economic data.

The months of November and December were astounding. The Dow index and the Nasdaq 100index made a new all-time closing high on Dec 13 and 15 respectively, and made repeated newhighs through the end of December. The Nasdaq 100 index gained 53.81% in 2023, its best yearsince 1993. Although the Nasdaq composite index has yet to make a new all-time high (since Nov19, 2021), it nevertheless put in a 43.42% gain in 2023, which is the best year since 2003. TheS&P 500 gained 24.23% for the year, just 0.55% shy of the all-time high made on January 3, 2022.

For most markets (and long-term investors) 2023 turned out to be a fabulous year. It was a year(in hindsight) making money is not that difficult after all. Just lie-flat and earn the outsized return.

To begin with, 3-month, 6-month, and 1-year USD deposits started the year at 4.77%, 5.11%, and5.44% respectively, peaked at 5.82%, 5.95%, and 6.00% respectively, and ended the year at 5.43%,5.37%, and 5.26% respectively.

3-month, 6-month, and one-year USD deposit rates:

The global fixed income market started the year on a firm tone, with respectable returns as themonths progressed into July, but retraced significantly in the months of August thru October.However, as the end of the rate hike cycle and 2024 rate cut expectations were priced-in, globalfixed income markets took off in the months of November and December.

2023 Global Fixed Income outperformers: US HY: +13.45%, EM Bond: +9.09%, US IG: +8.52%:

In fact, the US$65 trillion (equivalent) Bloomberg Global Aggregate Index gained 9.41% in November and December (vs 5.72% for the full year 2023), being the best two-month period performance since the index inception in January 1990.

Bloomberg Global Aggregate Index: 1990-2023 price graph:

The most followed benchmark interest rate in the world, the 10-yr UST yield started the year at 3.88%, dipped to 3.30% in early April with the SVB debacle recession fear (did not happen), briefly reached the 4.99% milestone in mid-October, and ended the year exactly at 3.88%. The UST curve remained inverted throughout the 2023, with the 10-yr vs 2yr spread at -37bp. The yield curve has been inverted since July 2022. Everyone who called for a US recession in 2023 based on the inverted yield curve wase painfully wrong. The US economic resilience defied every expectation.

The global equity markets have an incredible year (except for MSCI China and the HangSeng Index). Most notable were the semiconductor (SOX Index) which gained 64.90%, the Nasdaq 100 (NDX Index) gained 53.81%, and the Nasdaq Composite Index gained 43.42%.

Incidentally, the title of my final article for 2022 was “The pain of 2022 is the gain of 2023” was quite prescient.

Inflation across the globe has subsided. Central banks are ready to celebrate their success in containing inflation. However, market jubilation needs to be toned down. It is realistic to expect that 2022/2023 rate hike cycle has concluded, but the expectation of massive interest rate cuts is irrational. The speed and magnitude of rate cuts will be much slower and smaller than the 2022/2023 rate hikes.

US CPI Inflation:

The fixed income market has front run the Fed and the Santa Claus, and banked a large part of the 2024 expected returns in the months of November and December. We need to be realistically sanguine with the 10-yr UST yield at 3.88% and 2-yr UST at 4.25%.

Additionally, credit spreads (especially investment grade credits) have limited room to compress.

It is my belief that there is limited upside for the risk-free G-7 government bonds at the present level. The IG credit spreads offer little room for further compression.

I expect 2024 to be a surprisingly good year for the global equity markets, with the US markets continuing to lead, and the technology sectors to continuing to outperform (most likely not as much as in 2023).

The Nasdaq 100 Index put in a miraculous performance in 2023, gaining 53.81%, its best year since 1991 (surpassing the 47.58% gain in 2020). Those who favor the mean reversion argument, please remember that the Nasdaq 100 index had 5 consecutive years of double-digit gain in the later part of the 1990s(54% in 1995, 42.54% in 1996, 20.63% in 1997, 85.31% in 1998, and 101.95% in 2000). Of course, the Dotcom bubble burst, and three negative return years followed (-36.84% in 2000, -32.65% in 2001, and -37.58% in 2002). The 2023 outperformance was driven by the AI exuberant (like the internet era of the 1990s). I do not believe the AI era has ended in just oneyear, nor has the exuberance reached bubble territory.

I expect the bull run to spread to many non-tech sectors (financials and industrials) as well as small caps in 2024. In fact, in the months of November and December, the Dow index has gained 15.14%, and the small cap Russell 2000 index gained 21.95% in the two months. There is a high probability that the small caps (Russell 2000) will outperform the Nasdaq 100 (dominated by the magnificent Sevens) in 2024 (the relative percentages and mathematics).

I expect EM equitiesto recover in 2024, once the 2024 rate cut expectations started to be pricedin. Please note the MSCI EM +11.86% gain in November and December.

More importantly, there is an avalanche of money coming. Money market fund assets have increased from US$3.6 trillion before the pandemic to US$5.88 trillion recently, and bank deposits from under US$14 trillion to US$17.59 trillion recently. When rate cuts are being pricedin, we will see outflows from the lying flat money (money market funds and bank deposits) into risky assets. With fixed income priced to perfection, the beneficiary of choice will be US equitiesas well as EM equities.

US Dollar Money Market Fund AUM (US$5.88 trillion) and Bank Deposits (US$17.59 trillion):

Perhaps it is not too late to join the bull run?

1) The 2022-2023 interest rate hike cycle is over. However, interest rate cuts may not come soon, and interest rates are likely to remain high for longer than we expect. The first US rate cut may not come until Q3 2024.

2) Global economic growths are likely to slow in 2024, with the UK and Eurozone economies tipping into recession, and the US economy narrowly averting a recession with a soft-landing.

3) Global inflationary pressure continues to recede, with global central banks declaring victory on inflation.

4) When rate cuts are priced-in, trillions of risk-free capitals will flow from money markets funds and bank deposits to risk assets

5) Global equity markets continue to outperform in 2024, with the US equity market leading the world, and tech sector continues to perform well.