每周全球金融观察 |第 157 篇: 不要期待物极必反

来源:岭南论坛 时间:2024-01-22

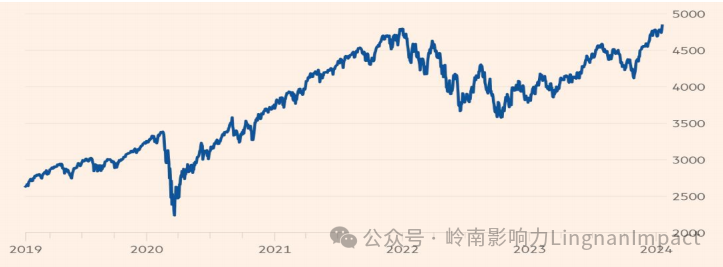

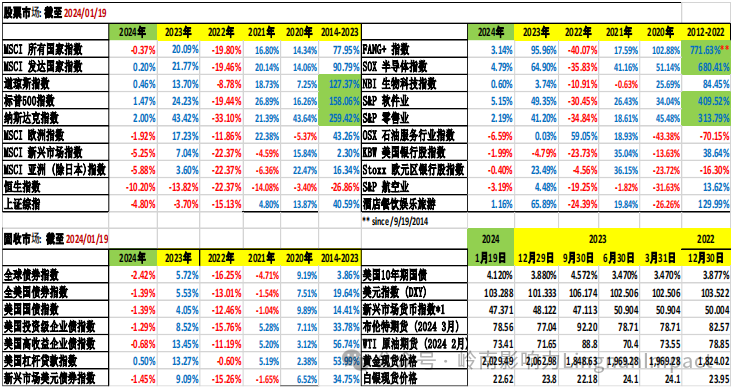

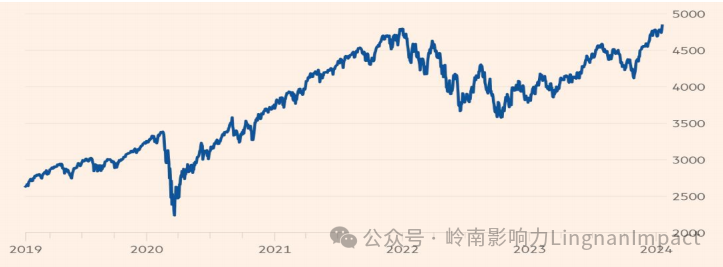

标普 500 周五收于 4839.81 点,创下历史新高。此前的历史新高是在 2022 年 1 月 3 日创下的,距今是 512 个交易日前。在周五的交易时段,其盘中价值也达到了 4,842.07 点的新高。这一新的里程碑意义重大,因为它预示着 2024 年将有更大的涨幅。道琼斯工业指数和纳斯达克 100 指数在 12 月份都创下了新高。纳斯达克综合指数距离 2021 年 11 月 19日创下的纪录还有约 5%的距离。

标准普尔 500 指数用了两年多一点的时间创下历史新高:

道指和纳斯达克 100 指数已创下历史新高,纳斯达克综合指数距离历史新高还有 5%的距离:

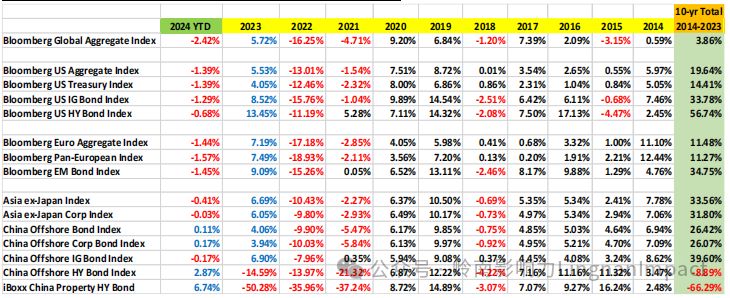

然而,股市的喜悦并没有蔓延到固定收益资产类别。在进入 2024 年后的几周里,人们对一系列快速、猛烈降息的预期越来越低。最近一连串强于预期的经济数据(12 月份火热的就业报告、高于预期的 12 月份消费物价指数数据以及本周强于预期的 12 月份零售销售数据)共同将市场的亢奋情绪打回现实。

正如我在 2023 年的最后一篇文章(第 155 期)和 2024 年的第一篇文章(第 156 期)中所写:市场的欢呼声需要缓和。预期 2022/2023 年加息周期已经结束是现实的,但预期大规模降息是非理性的。降息的速度和幅度将比 2022/2023 年的加息速度和幅度要慢得多,也小得多。

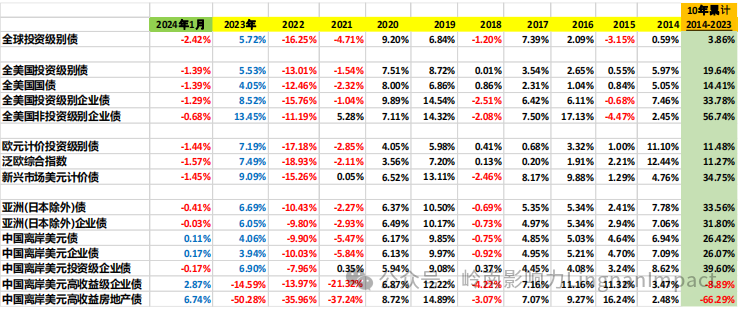

1 月份迄今为止,所有好于预期的经济数据都无一例外地体现在固定收益市场上(11 月和 12月是几十年来表现最好的两个月),让 2024 年充满了血腥味。

2024 年,固定收益市场开局艰难:

我必须指出,65 万亿美元(等值)的彭博全球综合指数在今年前三周下跌 2.41%,这并不令人欣慰,尤其是在 2021 年下跌 4.71%,2022 年下跌高达 16.25%之后。2023 年 5.72% 的回升幅度也相当微弱。

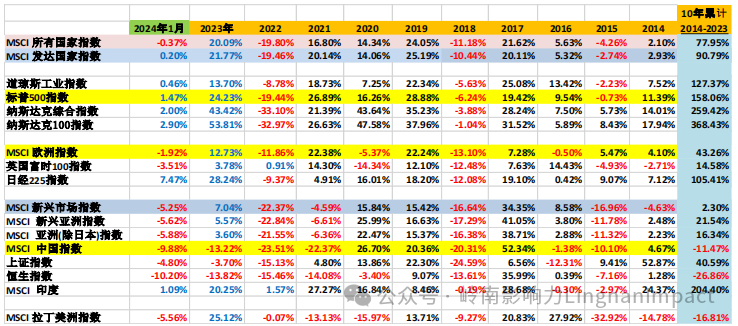

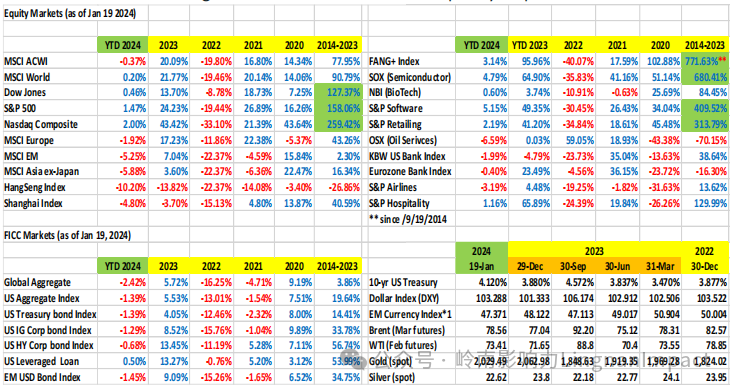

2024 、2023 及之前的收益对比:

所有数据截至 2024 年 1 月 19 日, *1 截至 1 月 18 日

2024 年我们该何去何从?

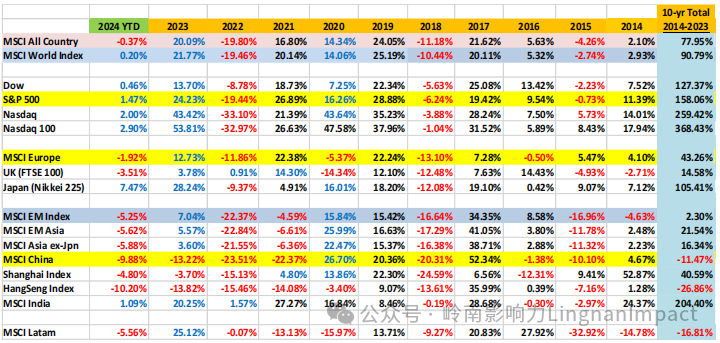

全球股票市场:

2023 年,全球股市表现优异(MSCI 中国指数和恒生指数除外)。在这一年的大部分时间里,科技板块("七豪勇")都引领着市场。进入 2024 年,前两周表现平平,但在 1 月 15 日假期缩短的一周里,市场创下了新的里程碑,尤其是标准普尔 500 指数在时隔两年后再创历史新高。

我预计 2024 年将是全球股市出人意料地好的一年,美国市场将继续表现出色,科技板块将独领风骚。

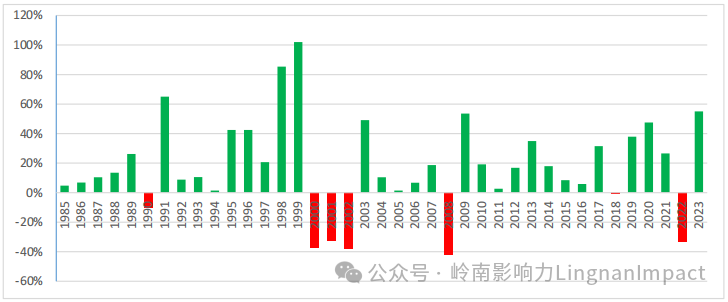

纳斯达克 100 指数在 2023 年创造了奇迹,上涨了 53.81%,是自 1999 年以来表现最好的一年。2023 年的优异表现是由人工智能的繁荣(就像 20 世纪 90 年代的互联网时代)推动的。我不认为人工智能时代在短短一年内就结束了,也不认为这种繁荣已经达到了泡沫的程度。

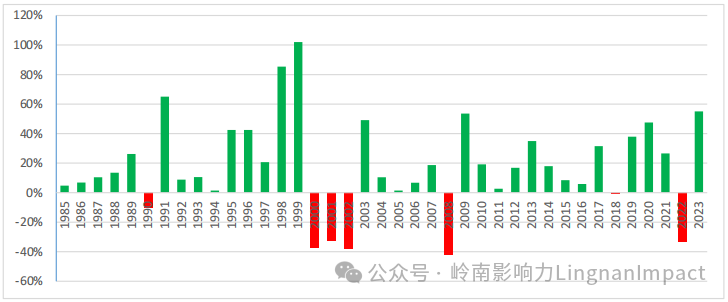

纳斯达克 100 指数自 1985 年创立以来的年度回报率:

半导体板块(SOX 指数)在 2022 年下跌 35.83% 之后,2023 年的涨幅高达 64.9%。由于百分比的谬误,SOX 指数周五收盘价 4,375.65 只比 2021 年 12 月 27 日创下的前高点 4,039.12 高出8.3%。2023 年 12 月 14 日,在道琼斯指数和纳斯达克 100 指数创下历史新高的同一周,SOX指数前一个高点再次被刷新。

半导体 (SOX 指数): 2013-2024 年价格图:

SOX 指数由 30 只股票组成,其中包括 Nvidia、AMD、Broadcom、Qualcomm、Intel、AppliedMaterial 以及台积电和荷兰半导体制造设备制造商 ASML 等杰出成员。

自 2009 年以来,SOX 指数的年度表现一直非常出色。2023 年的优异表现是由人工智能、英伟达(Nvidia)和 AMD 人工智能芯片推动的。我预计该行业在 2024 年将再次表现出色,因为人工智能革命将催生各种创新、扩散,并大幅增加对人工智能和通信半导体的需求,将该行业提升到史诗般的规模。

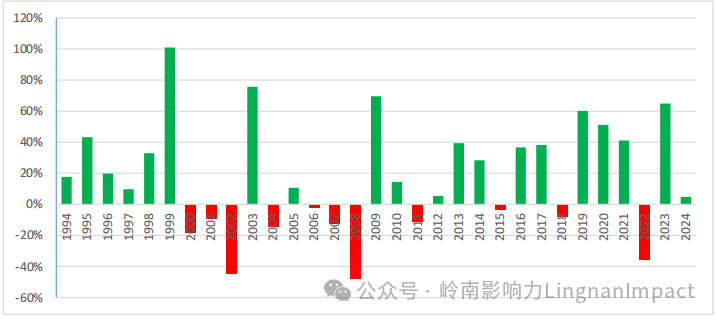

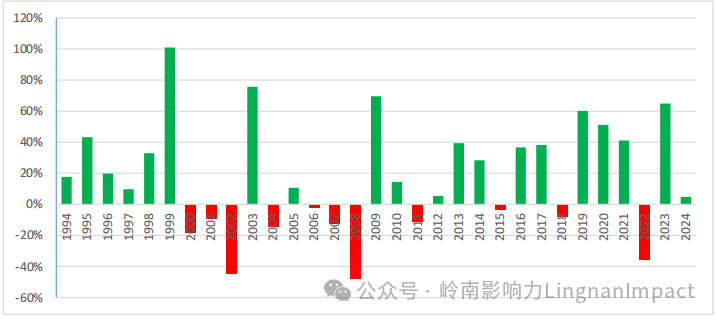

半导体 (SOX 指数)自 1994 年创立以来的年度回报率:

我必须指出的是,纳斯达克 100 指数和 SOX 指数之间存在高度重叠,SOX 指数中至少有 16个公司(指数共 30 个)也在纳斯达克 100 指数中,特别是英伟达(Nvidia)、AMD、博通(Broadcom)、高通(Qualcomm)、德州仪器(Texas Instruments)、应用材料(AppliedMaterial)、KLA Corp、ASML 等。

随着道琼斯指数和纳斯达克指数在 12 月份创下历史新高,标普 500 指数本周也创下历史新高,日经-225 指数 2024 年迄今涨幅为 7.47%(2023 年为 28.24%),除非发生意外的外部事件,否则全球市场不太可能出现逆转。最后,或许我们也应该在印度(科技股)投资一些。我记得华尔街有句被时间尊重的的格言:“不要与趋势抗争,趋势是你的朋友” 。

作者:蔡清福

Alvin C. Chua

2024 年 1 月 21 日星期日

Article #157: Don’t Expect Reversal, the Trend is Your Friend

The S&P500 Index closed at 4,839.81 on Friday, making a new all-time high. The previous all-time high was set on January 3, 2022, 512 trading sessions ago. Its intraday value also reached a fresh high of 4,842.07 during Friday’s trading session. This new milestone is significant, as it signifies further gains to come in 2024. Both the Dow Jones Industrial Index and the Nasdaq 100 Index made new highs in December. The Nasdaq Composite Index is about 5% away from its record set on November 19, 2021.

The S&P 500 Index took a little over 2-years to set a new all-time high:

The Dow and Nasdaq 100 Indices have made new all-time highs, the Nasdaq Composite is 5% away:

However, the equity market jubilation did not spread to the fixed income asset classes. The expectation of a fast and furious series of rate cuts grew dimmer and dimmer by the week as we entered 2024. The recent spade of stronger than expected economic data (Dec’s hot job report, the higher-than-expected Dec CPI data, and this week’s stronger than expected Dec retail sales figure collectively sent the exuberance back to reality check.

As I wrote in my final article (#155) of 2023 and first article (#156) of 2024: market jubilation needs to be toned down. It is realistic to expect that 2022/2023 rate hike cycle has concluded, but the expectation of massive interest rate cuts is irrational. The speed and magnitude of rate cuts will be much slower and smaller than the 2022/2023 rate hikes.

All the better-than-expected economic data so far in January invariably manifested in the fixed income market (with Nov and Dec being the best two-month performance in decades), getting off 2024 with plenty of bloody noses.

The fixed income market had a difficult start in 2024:

I must note, the US$65 trillion (equivalent) Bloomberg Global Aggregate Index losing 2.41% in the first 3-weeks of the year is not comforting, especially after a 4.71% loss in 2021, and a whopping 16.25% loss in 2022. The 5.72% recovery in 2023 was rather muted.

Please refer to the following table for YTD 2024 vs 2023 and prior year performance:

All data as of Jan 19, 2024, *1 as of Jan 18

Where do we go from here in 2024?

Global Equity Markets:

The global equity markets performed exceptionally well in 2023 (apart from MSCI China and the HangSeng Index). The tech sector (the magnificent 7) let the market for most of the year. Entering 2024, the first two weeks were uneventful, but the holiday shortened week of Jan 15 set new milestones, particularly with the S&P 500 Index making a new all-time high after 2-years.

I expect 2024 to be a surprisingly good year for the global equity markets, with the US markets continuing to perform well, and the technology sectors taking the lead.

The Nasdaq 100 Index put in a miraculous performance in 2023, gaining 53.81%, its best year since 1999. The 2023 outperformance was driven by AI exuberance (like the internet era of the 1990s). I do not believe the AI era has ended in just one-year, nor has the exuberance reached bubble territory.

Nasdaq 100 annual return since 1985 inception:

The semiconductor sector (SOX Index) delivered a whopping 64.9% gain in 2023, after a -35.83% debacle in 2022. Due to the fallacy of percentages, the SOX Index’s Friday closing level of 4,375.65 was only 8.3% higher than the previous high of 4,039.12 set on 12/27/2021. The previous high was re-set on Dec 14, 2023, the same week that the Dow and Nasdaq 100 set new all-time highs.

SOX Index: 2013-2024 price graph:

The SOX Index consists of 30 stocks, with distinguished members such as Nvidia, AMD, Broadcom, Qualcomm, Intel, Applied Material, as well as TSMC and the Dutch semiconductor manufacturing equipment maker ASML.

The SOX Index annual performance since 2009 has been exceptional. The 2023 outperformance was propelled by AI, the Nvidia and AMD AI chips. I expect the sector to perform well again in 2024, as the AI revolution will spawn all kinds of innovation, proliferate, and dramatically increase the demand for AI and communications semiconductor, lifting the industry to epic proportions.

Semiconductor Index annual return since 1994 inception:

I must note, there is a high overlap between the NDX and SOX indices, with at least 16 names (out of 30) in the SOX Index also in the Nasdaq 100 Index, notably Nvidia, AMD, Broadcom, Qualcomm, Texas Instrument, Applied Material, KLA Corp, ASML, etc.

With the Dow and Nasdaq indices making new all-time highs in December, and the S&P500 Index this week, and the Nikkei-225 index gaining 7.47% YTD 2024 (and 28.24% in 2023), the global markets are unlikely to reverse course, barring unexpected exogenous events. Lastly, perhaps we should have some exposure in India (tech) too.

I remember a time-honored quotation on Wall Street “don’t fight the trend, the trend is your friend.”

By Alvin Chua

Sunday January 21, 2024