每周全球金融观察 | 第 150 篇:债券义和团的归来

来源:岭南论坛 时间:2023-09-11

由于本周没有新的企业盈利报告,市场只能从经济数据和地缘政治动态中寻找可能影响市场的指引。最近,债券市场一直在引领股市,因为它是通胀趋势和经济增长的投票器,而通胀和经济增长将推动全球货币政策的下一步行动。

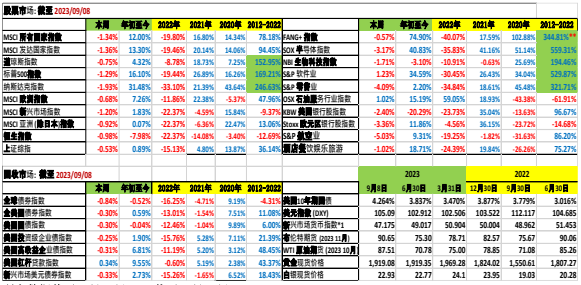

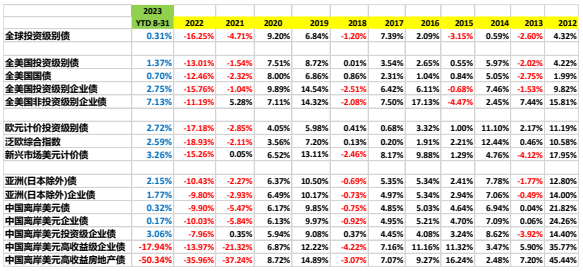

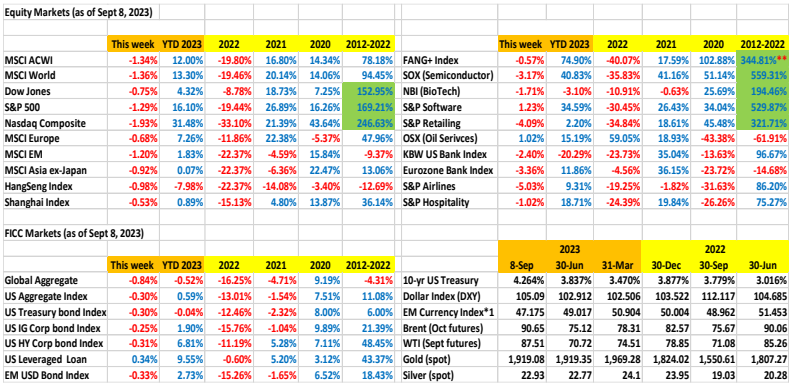

总体而言,本周全球债券市场表现不佳,彭博全球综合指数(-0.84%)、美国综合指数(-0.30%)、美国国债指数(-0.30%)、美国 IG 债券指数(-0.25%)、美国 HY 债券指数(-0.31%)和新兴市场债券指数(-0.33%)均收红。截至 9 月 8 日,60.5 万亿美元(等值)的彭博全球综合指数年度回报率为 -0.52%,而 2022 年和 2021 年的回报率分别为 -16.25%和 -4.71%。

债券义和团**主宰...... **1983年7月27日,华尔街资深人士埃德-亚德尼(Ed Yardeni)创造了 "债券义和团"(Bond Vigilantes)一词。它意在说明债券市场的力量和影响力,使财政和货币政策保持警惕和良好的行为。债券市场(参与者)的影响力在 20 世纪 90 年代的克林顿政府时期达到了顶峰(这是美国最后一次出现预算盈余,美国联邦未偿债务减少)。克林顿的竞选战略家詹姆斯-卡维尔(James Carville)曾说过一句名言:"如果有转世投胎的机会,我希望能以债券市场的身份回来。你可以恐吓所有人"。

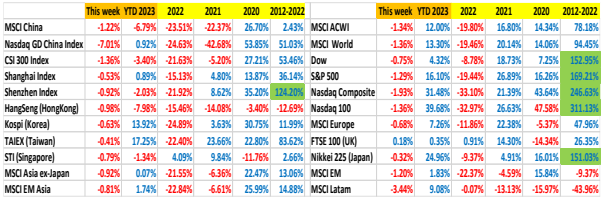

本周全球股市出现了抛售,尽管幅度不大,但也不乏一些绩优科技股:苹果(-5.95%)、英伟达(-6.05%)和纳斯达克综合指数(-1.93%)。从历史上看,9 月份是股市回报率最差的月份。然而,10 月份是股票市场最好的 5 个月(10 月至 2 月)。

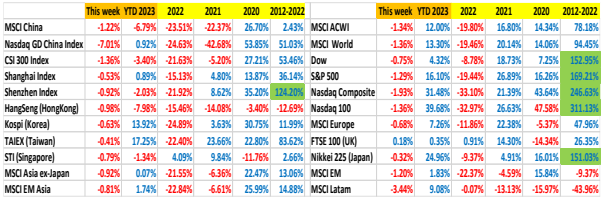

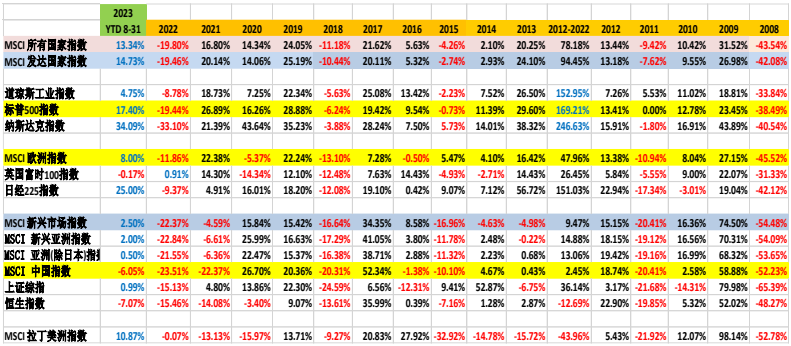

请参阅下表,了解 2023 财年与往年的业绩对比:

7 月份,全球主要股票指数均以高位收盘,但 8 月份的情况却大相径庭,前三周的走势均出现反转,在第 4 周出现回升。

从历史上看,9 月份对股市来说是一个艰难的月份,10 月到次年 2 月是股市表现最好的5 个月。然而,随着通胀消退、加息周期预期结束以及全球经济(尤其是美国)出人意料的恢复力,今年 9 月或许会有所不同。

对于全球固定收益市场来说,8 月份是充满挑战的一个月,债券警戒者主导了市场。市场认为美联储不会再加息。然而,由于降息可能还需要 9-12 个月的时间,固定收益市场将不得不面对数月的逆风,以及延迟降息带来的暴利。

进入 2023 年的最后 4 个月,通货膨胀可能会以意想不到的方式袭击我们: 1)黑海谷物出口结束;2)沙特-俄罗斯石油减产;3)极端气候条件,这将对食品和能源价格产生不利影响。

2022 年 7 月,在土耳其和联合国的斡旋下,俄罗斯和乌克兰达成协议,允许货轮沿黑海通道航行。根据联合国粮食及农业组织(UN Food and Agriculture Organization)的数据,在该协议下,近 3300 万吨谷物从乌克兰运出,世界粮食价格因此下降了约 20%。然而,由于俄罗斯在今年七月中旬退出了该协议,预计世界粮食价格将再次上涨。

本周,沙特阿拉伯和俄罗斯将石油自愿减产协议延长至 2023 年底。我注意到布伦特原油期货本周收盘价为 90.65 美元,WTI 原油期货收盘价为 87.51 美元,明显高于 6 月底的75.12 美元和 70.72 美元。

我们每个人都会注意到 2022 年和今年的极端气候状况。今年夏天,北半球气温创历史记录新高。干旱和洪水更加频繁,导致农作物受损和粮食通胀。香港--我目前居住的城市--在 9 月 7/8 日的 24 小时内录得 600 毫米(近 2 英尺)的降雨量(相当于年平均降雨量的25%),导致大面积水灾,部分城市的财产遭到破坏。

通胀九头蛇**可能卷土重来...

** 在希腊神话中,"九头蛇 "是一种九头怪兽。如果砍掉一个头,就会冒出另外两个头。在现代英语中,"九头蛇 "或 "hydra-headed "可以形容困难或复杂的情况。

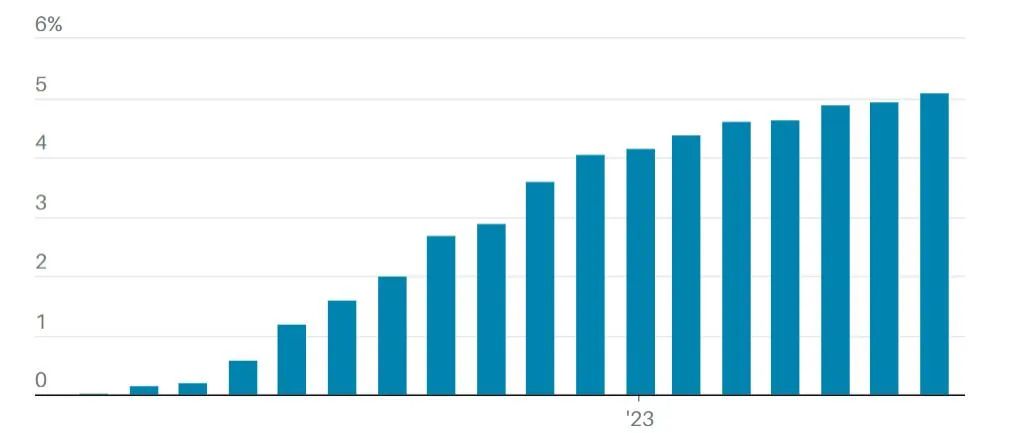

自 2022 年中期以来,美元货币市场基金资产管理规模持续上升,在 9 月 6 日报告周创下 5.62 万亿美元的历史新高。是什么促使资金源源不断地流入货币市场基金资产类别?

答案就是收益率。2008 年 9 月,货币市场基金面临 "破发"(即扣除费用后收益率为负)的风险。2022 年 2 月(美联储加息前)的平均收益率只有可怜的 2 个基点,7 月 31 日达到 5.08%,9 月 7 日达到 5.16%(增长了 250 倍)。

对于那些喜欢比周/月货币市场基金更长期限的人来说,银行存款将是一个无风险的替代选择。根据美联储数据,9 月 8 日: 3 个月、6 个月和 12 个月美元存款平均利率分别为5.61%、5.90% 和 5.95%。请注意:存款利率受大面额存款的影响。

随着 9 个月至 1 年后的预期降息(利率长期居高不下),世界已经发生了变化,对储蓄者和 "富人"(拥有财富的人)有利。对于规避风险的投资者来说,在降息之前,具有日常流动性且收益率为 5.16% 的无风险资产类别是所有风险资产类别的有力替代品。

作者:蔡清福

Alvin C. Chua

2023 年 9 月 9 日, 星期六

东亚和中国股票市场的表现与全球同行的比较:

Article #150: The Return of The Bond Vigilantes

With no fresh corporate earnings report this week, the market defaulted to economic data and geopolitical dynamics for guidance on how they may impact the markets. Lately, it has been the bond marketsleading the stock markets, by being a vote on inflation trends and economic growth that will drive the next moves in global monetary policies.

Overall, it was not a good week for global bond markets, with the Bloomberg Global Aggregate Index (-0.84%), US Aggregate index (-0.30%), US Treasury index (-0.30%), US IG bond index (-0.25%), US HY bond index (-0.31%), and EM bond index (-0.33%) all in the reds. The US$60.5 trillion (equivalent) Bloomberg Global Aggregate Index YTD return is -0.52% as of Sept 8, after a -16.25% return in 2022 and -4.71% in 2021.

Bond Vigilantes** are in charge …

**Wall Street veteran Ed Yardeni coined the phrase “Bond Vigilantes” on July 27, 1983. It meant to illustrate the power and influence of the bond market, to keep the fiscal and monetary policies on guard and well behaved. The influence of the bond market (participants) climaxed in the 1990s during the Clinton Administration (the last time there was a budget surplus in the US, and a reduction in the US federal debt outstanding). James Carville, Clinton’s campaign strategist was famously quoted as saying “if there is a reincarnation, I would like to come back as the bond market. You can intimidate everybody.”

The global equity markets sold off this week, although not significant, except for selective high flying tech names: Apple (-5.95%), Nvidia (-6.05%) and the Nasdaq composite index (-1.93%). Month of September historically has been the worst month for stock market returns. However, October starts the best 5 months (Oct-Feb) for equities.

Please refer to the following table for YTD 2023 performance vs prior years:

After a blow-out July where every major global equity index closed out the month on a high note, the month of August was quite a reversal for the first 3 weeks with recovery in the 4th week.

September has historically been a tough month for equities, with October through February being the best five months. However, with receding inflation, end of rate hike cycle expectation, and surprising resilience in global economies (especially in the US), perhaps this September could be different.

August was a challenging month for the global fixed income markets, with bond vigilantes dominating the market. Market is pricing in no more Fed rate hikes. However, with rate cuts likely to be 9-12 months away, the fixed income markets will have to contend with months of headwind, and the delayed rate cut windfall.

As we enter the last 4 months of 2023, inflation may hit us in an unexpected way: 1) the end of Black Sea grain exports; 2) Saudi-Russia oil production cut back; 3) Extreme climate conditions, which would adversely affect food and energy prices.

In July 2022, a deal was struck between Russia and Ukraine (brokered by Turkey and the UN) allowing cargo ships to sail along a corridor in the Black Sea. Almost 33 million tons of grain were shipped from Ukraine under the deal, and world food prices declined by roughly 20% as a result,according to the UN's Food and Agriculture Organization. However, since Russia pulled out of the deal in mid-July, it is expected that world grain prices would rise again.

This week, Saudi Arabia and Russia extended voluntary oil production cuts to the end of 2023. I note the Brent crude oil futures ended the week at $90.65 and the WTI crude oil futures at $87.51, significantly higher than $75.12 and $70.72 at the end of June.

Every one of us would have noticed the extreme climate conditions in 2022 and this year. The northern hemisphere recorded the hottest temperature this summer. Drought and flooding have been more frequent, resulting in crop damage and food inflation. Hong Kong - the city where I am presently residing, 600mm (almost 2 feet) of rainfall was recorded over a 24-hour period on Sept 7-8 (25% of average annual rainfall), resulting in massive flooding and property damage to parts of the city.

The inflation hydra** may be back …

** In Greek mythology, “Hydra” is a nine-headed monster. If one head is decapitated, two more will spring forth. In modern English, hydra or hydra-headed can describe a difficult or multifarious situation.

USD money market fund AUM has been rising steadily since the middle of 2022, repeatedly reaching new all-time highs, to reach US$5.62 trillion on September 6 reporting week. What prompted this relentless in-flow into money market fund asset class?

The answer is yield. In September 2008, money market fund was at risk of “breaking the buck”(ie negative yield after fee). The average yield was a pathetic 2bp in Feb 2022 (before the Fed rate hike) and reached 5.08% on July 31, and 5.16% on September 7 (a 250- fold increase).

For those who prefer longer duration than the weekly/monthly MMF, bank deposits would be arisk-free alternative. According to Fed data, the average 3-month, 6-month and 12-month USD deposit rates on Sept 8 were 5.61%, 5.90% and 5.95%. Please note: the deposit rate is skewed by large denomination deposits.

With the anticipated rate cuts 9 months to a year away (higher for longer), the world has changed, in favor of the savers and the “haves” (those who have wealth). A risk-free asset class with daily liquidity and yielding 5.16% is a formidable alternative to all risk-asset classes for risk averse investors, until the rate cuts.

East Asia and China equity markets performance vs the global peers: